Workers' compensation insurance is coverage purchased by the employer/business that provides benefits for job-related employee injuries, with a few exceptions. Florida law requires most employers to purchase workers' compensation coverage. Under a workers' compensation policy, employees are compensated for occupationally incurred injuries, regardless of fault. This coverage makes employers immune from some injury lawsuits by employees.

The Office of Insurance Regulation (OIR) provides important oversight for those writing workers’ compensation coverage in Florida. OIR regulates the rates, forms and financial solvency for workers’ compensation insurers as part of its mission to maintain a robust and competitive market and maintain protections for the insurance-buying public.

In Florida, the Division of Workers' Compensation within the Department of Financial Services (DFS) is the primary regulator for ensuring employees receive the proper benefits under this coverage, which includes benefits for medical expenses, disability, or death.

FLORIDA WORKERS’ COMPENSATION

How Does Workers’ Compensation Work?

If your employees have a job-related injury or illness, your workers’ compensation insurance can help pay for important benefits like medical expenses. This includes care for repetitive stress injuries, and ongoing treatments, like physical therapy.

This coverage also helps replace lost wages if you have injured workers who need time off to recover from a work-related injury or illness. It can also help cover a permanent disability that keeps your employee from returning to work. It’ll even help cover funeral costs if a job-related accident causes the death of an employee.

Florida Workers’ Compensation Laws

The Division of Workers’ Compensation in Florida helps ensure businesses have the resources for workers’ comp programs. They’re able to help injured workers’, employers, health care providers and insurers follow Florida laws. They can help you find out:

If you need Florida workers’ compensation coverage

When injured or sick employees can receive benefits

How much to pay workers’ comp attorneys

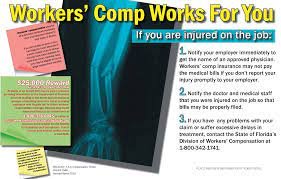

Workers’ Compensation Notice

The law requires that every employer who has secured workers’ compensation coverage post in conspicuous place(s) a notice that contains the employer’s insurance carrier information, the expiration date of the policy and an anti-fraud statement. The Division of Workers’ Compensation has developed this notice, in poster form, for carriers to provide to their policyholders. Your carrier is required by law to provide you with the poster(s). Even if employers have purchased workers’ compensation policies, they shall be deemed to have failed to secure workers’ compensation coverage if they have committed any of the following actions:

materially understated or concealed payroll,

materially misrepresented or concealed employee duties to avoid proper classification for premium calculations, or

materially misrepresented or concealed information pertinent to the computation and application of an experience modification factor.

Employers who fail to secure workers’ compensation coverage or fail to update information on their workers’ compensation insurance application are subject to stop work orders and civil and criminal penalties.

FLORIDA’S COVERAGE REQUIREMENTS

Employers conducting work in the State of Florida are required to provide workers’ compensation insurance for their employees. Specific employer coverage requirements are based on the type of industry, number of employees and entity organization. To determine coverage requirements for a specific employer, the following information is provided by the Bureau of Compliance.

Construction Industry - One (1) or more employees, including the owner of the business who are corporate officers or Limited Liability Company (LLC) members. For a list of the trades considered to be in the construction industry see 69L-6.021 Florida Administrative Code.

Non-Construction Industry - Four (4) or more employees, including business owners who are corporate officers or Limited Liability Company (LLC) members.

*Please note: Non-construction industry Sole Proprietors or partners in a Partnership are

not employees unless they want to be included on the business' Workers' Compensation Insurance policy and file a form DWC 251 PDF with the Division of Workers' Compensation.

Agricultural Industry - Six (6) regular employees and/or twelve (12) seasonal workers who work more than 30 days during a season but no more than a total of 45 days in a calendar year.

Out of State Employers must notify their insurance carrier that they are working in Florida. If there is no insurance, the out of state employer is required to obtain a Florida Workers’ Compensation Insurance policy with a Florida approved insurance carrier which meets the requirements of Florida law and the Florida Insurance Code. This means that "Florida" must be specifically listed in Section 3A of the policy (on the Information Page).

An Extraterritorial Reciprocity clause in the home state’s statute allows some out of state Employers to work in Florida temporarily using their home state’s Workers' Compensation insurance policy.

Contractors are required to make certain that all sub-contractors have the required Workers' Compensation Insurance before they begin work on a project. To see the documentation that is required from a sub-contractor, see 69L-6.032 Florida Administrative Code.

If the sub-contractor does not have Workers' Compensation Insurance for its employees, those workers become the employees of the contractor. If an injury occurs, the contractor is responsible for paying the benefits for the work-related injury, illness or fatality.

Exemptions are available to business owners who opt out of the insurance coverage protections for themselves and who meet the requirements for an exemption.

FLORIDA WORKERS’ COMPENSATION EXEMPTION

There are a few Florida workers’ compensation exemptions for companies and employees who may not need coverage. For instance, sole proprietors and partnerships can go without workers’ comp coverage by filing for a certificate of election to be exempt. However, these businesses can still buy a policy by filing for election of coverage with The Division of Workers’ Compensation.

Some other workers’ compensation exemptions include:

Corporations Outside Of The Construction Industry must register with the Florida Department of State Division of Corporations. An officer of the company will need to apply for an exemption from workers’ compensation.

Limited Liability Companies (LLCs) outside of the construction industry must register with the Florida Department of State Division of Corporations. The applicant must have at least a 10% ownership of the LLC, and there can’t be more than 10 members be exempt.

For businesses in the construction industry, the eligibility for exemption is different.

Corporations And LLCs In The Construction Industry must register with the Florida Department of State Division of Corporations.

An officer of the corporation or LLC member with at least 10% ownership will need to apply.

No more than three officers or members can be exempt.

There is a $50 application fee.

Florida’s Division of Workers’ Compensation has more details on these exemptions.

WORKERS’ COMPENSATION PROCESS

first report of injury

As soon as you become aware of a work-related injury or illness, immediately contact your workers’ compensation insurance carrier. If you do not report the injury or illness to your insurance carrier within seven days of the date you were informed, you may be subject to an administrative fine not to exceed $2,000 per occurrence. Most insurance companies have a toll-free number to report work-related injuries. If you report the injury or illness to the insurance carrier by telephone, the carrier will complete the form and send a copy to you and the employee within three business days. You can also fill out the First Report of Injury or Illness form (DWC-1) and send it to the insurance carrier. The form contains employer, employee and accident information and can be obtained on the Division of Workers’ Compensation Web. You must also provide a copy of the First Report of Injury or Illness form to the employee. The employee’s signature on the form is preferred, but if the employee is not able or available to sign it, then write “not available” in the employee signature box.

workplace fatalities

Employers must also report deaths resulting from work-related injuries or illnesses to the Division of Workers’ Compensation within 24 hours. To report a workplace fatality, call 1-800-219-8953 (in Florida) or 850-413-1611, or fax the First Report of Injury or Illness form containing the fatality information to 850-354-5100.

what your employee can expect from the insurance carrier

Timely provision of medical treatment

Timely payment of wage replacement benefits

Timely payment of medical bills

Timely reporting of the employee’s claim information to the Division of Workers’ Compensation

Timely notification of any changes in the status of the employee’s claim

This information should be provided to the injured worker by mail on either a Notice of Action/Change form (DWC-4) or a Notice of Denial form (DWC-12)

medical benefits

As soon as you notify your carrier about your employee’s work-related injury, the carrier will:

Determine the compensability of the injury

Provide an authorized doctor

Pay for all authorized medically necessary care and treatment related to the injury or illness

Provide a one-time change of physician within five business days of receipt of your written request

Authorized treatment and care may include:

Doctor’s visits

Hospitalization

Physical therapy

Medical tests

Prescription drugs

Prostheses

Travel expenses to and from authorized providers or pharmacies.

Upon reaching maximum medical improvement (MMI), the employee is required to pay a $10 copayment per visit for medical treatment. MMI occurs when the treating physician determines that the employee’s injury has healed to the extent that further improvement is not likely.

Wage replacement benefits

Workers’ compensation benefits for lost wages will start on the eighth day that the injured employee is unable to work. The injured employee will not receive wage replacement benefits for the first seven days of work missed unless he or she is out of work for more than 21 days due to the work-related injury. In most cases, the wage-replacement benefits will equal two-thirds of the employee’s pre-injury regular weekly wage, but the benefit will not be higher than Florida’s average weekly wage. If the employee qualifies for wage replacement benefits, he or she can expect to receive the first benefit check within 21 days after the carrier becomes aware of the injury or illness, and bi-weekly thereafter. The injured employee will be eligible for different types of wage replacement benefits, depending on the progress of the claim and the severity of the injury.

Temporary Total Benefits: Temporary total disability benefits are two-thirds of your average weekly wage just before the injury, up to a legal maximum that's adjusted annually. For injuries in 2020, the maximum is $971 per week. For some severe injuries like paralysis or blindness, the benefit rate is higher: 80% of the employee's pre-injury wages for the first six months, without a maximum. The legal minimum is $20 per week.

Temporary total disability benefits will continue until the earliest of three events:

your doctor says you can go back to work

your doctor says that your condition won't improve, even with further medical treatment (a stage called "maximum medical improvement," or MMI); or

you've reached the maximum amount of time for temporary disability benefits.

Florida law says that temporarily disabled workers may not receive these benefits for more than two years (Fla. Stat. Ann. § 440.14). However, the state's supreme court has found that the 104-week limit is unconstitutional when it's applied to cut off benefits for someone who has hit that limit but hasn't reached MMI and is still totally disabled; the court said that the appropriate fix would be to apply the previous 260-week limit in that situation (Westphal v. City of St. Petersburg, 194 So.3d 311 (Fla. 2016)).

Temporary Partial Benefits: You may receive temporary partial disability benefits if your condition hasn't reached MMI but your doctor has said that you can return to work with some restrictions (such as not lifting heavy objects or using a keyboard for limited periods). If you earn less when working with these restrictions than you did before, these benefits will be 80% of the difference between your current earnings and 80% of your pre-injury wages. For example, suppose you used to earn $1,000 a week but now earn $600. You would subtract $600 from 80% of $1,000 (or $800), to get $200. You would then receive 80% of $200, or $160 per week.

Permanent Impairment Benefits: These benefits are provided when the injury causes any physical, psychological, or functional loss and the impairment exists after the date of MMI. A doctor will assign a permanent impairment rating, expressed as a percentage of disability to the body as a whole. If you return to work at or above your pre-injury wage, the permanent impairment benefit is reduced by 50%.

Permanent Total Benefits: If your doctor finds you have a permanent disability that keeps you from doing any work (even a sedentary job), you will be eligible to receive permanent total disability benefits at the same rate as your temporary total disability benefits. These benefits will continue until you're 75 years old (or for the rest of your life if you don't qualify for Social Security benefits). Certain severe injuries—such as amputation of an arm or leg or severe brain injury—are automatically considered to cause permanent total disability.

Death Benefits: Compensation for deaths resulting from work-related injuries or illnesses include payment of funeral expenses and dependency benefits (each are subject to limits defined by law). A dependent spouse may also be eligible for job training benefits.

wage statement form

You must complete and provide a wage statement form (DFS-F2-DWC-1a) to your carrier for any employee who is entitled to wage replacement benefits, within 14 days after knowledge of the accident. You must also complete this form upon the termination of the employee or upon termination of fringe benefits for any employee who is collecting wage replacement benefits within seven days of such termination.

(Q) I hire sub-contractors, aren’t they responsible for their own insurance?

(A) Yes, each sub-contractor is responsible for providing Workers' Compensation insurance for their workers in the event of a work-related injury, illness, or fatality. However, the primary contractor is responsible for ensuring that the sub-contractor has provided the coverage for its workers. If a worker is injured, without being protected by insurance, then the contractor becomes responsible for the payment of benefits.

(Q) What does the contractor need to obtain from the sub-contractor to verify coverage?

(A) Prior to the beginning of the job the contractor must obtain the following:

If the sub-contractor has a Workers' Compensation insurance policy, obtain any of the following from the sub-contractor:

A copy of the "Information Page" of the subcontractor’s workers' compensation insurance policy;

A screen print from the Division of Workers' Compensation, Proof of Coverage database confirming that workers' compensation coverage is in effect for the subcontractor, or

A Certificate of Liability Insurance and written documentation obtained either from the producer or carrier confirming that workers' compensation coverage is in effect for the subcontractor.

If the sub-contractor is a client company of an employee leasing company, you must obtain a Certificate of Liability Insurance and a list of the employees leased to the subcontractor obtained from the employee leasing company as of the date the subcontractor commenced work for the contractor on each project.

If the sub-contractor has an exemption for the business owner(s) then you may obtain either a copy of the exemption from the sub-contractor or a screen print of the exemption page from the Division of Workers’ Compensation, Exemption Search database.

(Q) How much does Workers' Compensation Insurance cost?

(A) The cost of Workers' Compensation insurance is based upon 3 primary factors: the payroll for the business, the type of work performed by the employees, and the individual employer’s claims history. Premium discounts may also be available to employers. Two of the more common discounts include a 2% discount for a workplace safety program and a 5% discount for a drug free workplace program. Each of these programs must be renewed every year in order to receive the discount.

(Q) Is it legal to call all of my workers "independent contractors" and avoid having to have Workers' Compensation Insurance for them?

(A)

Florida's workers' compensation law does not allow for independent contractors in the construction industry. The person is either a business owner or an employee of a business.

In the non-construction industry, there are specific criteria in the Workers’ Compensation law that identifies persons as “independent contractors”. For more information please review Section 440.02(15)d1, Florida Statutes.

The ultimate decision as to independent contractor status is with the person alleged to be independent and that person is responsible for proving that they are an independent contractor for Workers’ Compensation purposes.

(Q) How many days do employees have to report work-related injuries or illnesses?

(A) Employers should encourage employees to report accidents as soon as the work-related injuries or illnesses occur. By law, however, employees are required to report work related injuries or illnesses within 30 days.

(Q) To whom should I report the work-related injury?

(A) You should report the accident to your insurance company as soon as you have knowledge of the injury. By law, you have seven days from your first knowledge of the work-related injury.

(Q) Do I have to report a claim if I do not believe it is a work-related injury or illness?

(A) Yes. You should report all claims of work-related injuries or illnesses to your workers’ compensation insurance carrier. This includes claims in which there are no witnesses of the injury or illness. It is your workers’ compensation insurance carrier’s responsibility to investigate all claims and determine if employees are entitled to benefits under Florida’s Workers’ Compensation Law.

(Q) Does the employee pay any part of my workers’ compensation insurance premium?

(A) No. The law is very specific on this point. It is the employer’s responsibility to pay the entire premium for workers’ compensation. Employers who secure workers’ compensation coverage can also apply to become a drug-free workplace and may receive a premium discount. To learn more about the Drugfree Workplace Program, please call the Division of Workers’ Compensation Customer Service Office at 850-413-1609.

Q) Who should I call if my employees have questions or concerns regarding their workers compensation claims?

(A) You should first contact your insurance carrier. If your carrier is unable to answer the question or resolve the problem, you or your employees should call the Employee Assistance and Ombudsman Office at 1-800-342-1741.

(Q) When one of my employees is injured who tells them of their rights and responsibilities?

(A) When an injury is reported to the carrier, the carrier is responsible for sending a notice containing their rights and responsibilities to the injured worker. This notice also contains a Fraud Statement which must be signed by the injured worker and returned to the carrier, prior to any indemnity benefits being paid.

(Q) What kinds of employee injuries are covered?

(A) The law covers all accidental injuries and occupational diseases arising out of and in the course and scope of employment. This includes diseases or infections resulting from such injuries. The law also covers death resulting from such injuries within specified periods of time. Even if you do not think an injury is covered, you must still file the First Report of Injury or Illness (DWC-1) with your insurance carrier for determination of responsibility within 7 days of your first knowledge of the accident/injury.

(Q) What injuries are not covered?

(A) The law does not provide compensation for the following conditions:

Mental or nervous injury due to stress, fright, or excitement;

Work related condition that causes an employee to have fear or dislike for another individual because of the individual's race, color, religion, sex, national origin, age, or handicap;

"Pain and suffering" has never been compensable in Florida, nor is it compensable in any other state. The employer may not sue an injured worker for causing a catastrophe nor can the injured worker sue the employer for their injury. This trade-off makes it possible for injured workers to receive immediate medical care, at no cost to the injured worker, without any consideration for who was at fault, the employer or the employee. In civil law, negligence must be established through litigation before any compensation is awarded.

(Q) Compensation will not be paid in several other instances:

(A) If the injury is caused by the employee's willful intention to injure or kill himself or another, if the injury is caused primarily because the employee is intoxicated or under the influence of drugs, if the injury or death of the employee is covered by the Federal Employer's Liability Act, the Longshore and Harbor Workers' Compensation Act, or the Jones Act (if the injured worker is a "seaman" or member of a crew).

The IDEA Club

glen d. wieland

WIELAND & DELATTRE, P.A.

Glen Wieland graduated from Presbyterian College in 1979 and went on to obtain his law degree from Cumberland School of Law at Samford University. In 1982, he began his law career with the firm of Walker and Buckmaster, P.A., representing employers, insurance carriers and plaintiffs in both personal injury and workers’ compensation. In 1987, he joined Jim Kelaher and formed Kelaher & Wieland, P.A., representing only plaintiffs in both personal injury and workers’ compensation cases. He became board certified in workers’ compensation in 1990 and has remained board certified since that time. The firm is now know as Wieland & Delattre, P.A.

After an injury, you need someone you and your family can depend on throughout the recovery process. At Wieland & DeLattre, we have dedicated our service to advocating for injured individuals in Orlando and throughout Florida for over 24 years. We will stand by you to ease your physical and financial stress after any injury, including motor vehicle collisions and construction site accidents.